Life insurance denials tend to increase during the winter months due to a combination of weather-related risks, seasonal health complications, and specific clauses within life insurance policies. Understanding these factors can help beneficiaries avoid unexpected denials and ensure claims are paid. Why Do Life Insurance Denials Increase During Winter? Winter months often bring colder temperatures […]

Category Archives: Denied Life Insurance Claim

For beneficiaries, receiving a life insurance payout is often crucial after the death of a loved one. However, waiting for the payout can be a stressful experience. In this guide, we explore the typical timeline for life insurance payouts, common delays, factors that influence how long beneficiaries may wait, and steps to take in case […]

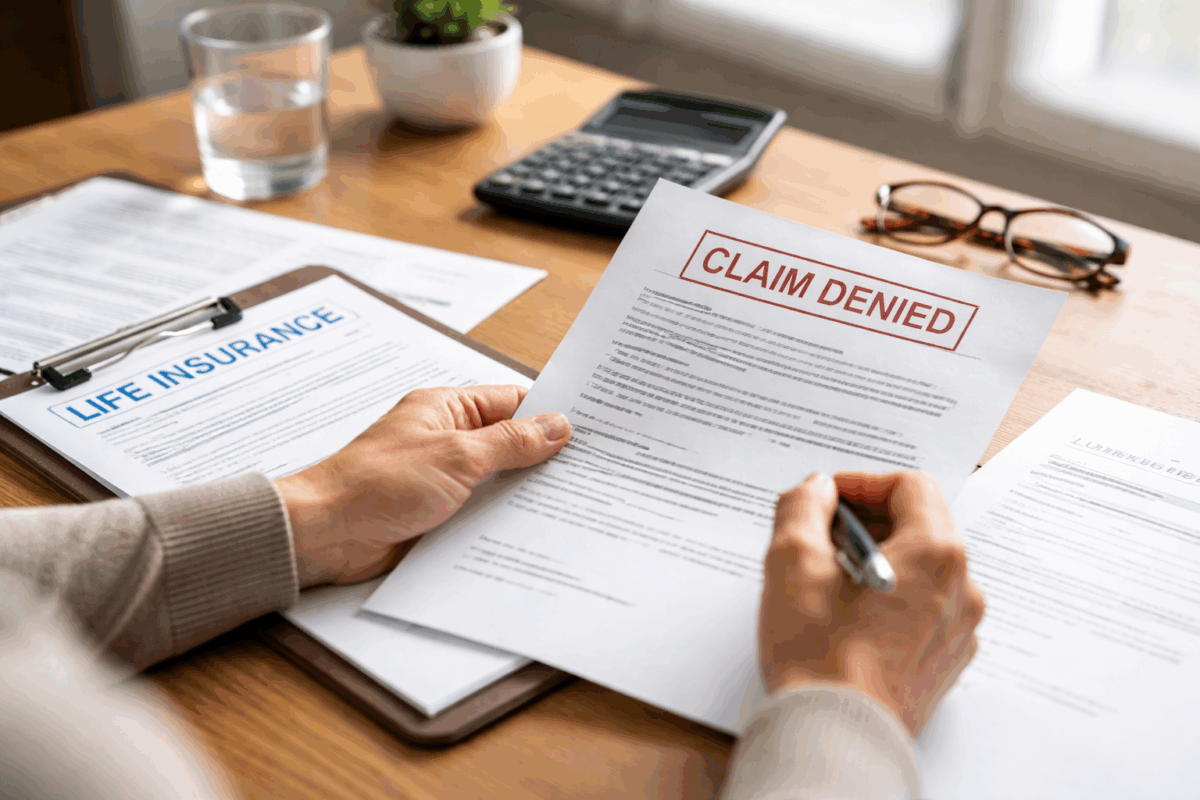

When a life insurance claim is denied, policyholders often feel helpless, especially when they know their claim should have been valid. Whether it’s due to an alleged misrepresentation of income, failure to disclose a pre-existing condition, or other concerns, the denial of life insurance coverage can significantly impact the beneficiaries’ financial future. Fortunately, New York […]

Life insurance coverage can be a lifesaver for your loved ones, but lapses in coverage can lead to severe consequences. In New York, grace periods, late notices, and winter mail delays can all play a role in whether or not you are able to keep your policy active. If your life insurance has lapsed, understanding […]

A life insurance claim denial can be overwhelming for beneficiaries already dealing with the loss of a loved one. However, the first steps taken after the denial are crucial in determining whether the claim can be overturned. This guide will walk you through the key actions to take if a claim is denied, ensuring that […]

A life insurance claim denial is one of the most distressing events beneficiaries can face, especially in the midst of grieving. However, the process of challenging the denial and ensuring that the insurance company honors the claim doesn’t have to be overwhelming. One of the most crucial steps in this process is to gather the […]

When a loved one passes away, it’s an emotionally charged time, and the last thing anyone wants to deal with is a life insurance claim denial. However, one issue that can complicate this process is the presence of alcohol or drug use on the death certificate. In some cases, life insurance companies may use this […]

When a life insurance claim is denied, it can be a devastating blow. The emotional toll of losing a loved one is compounded by the stress of trying to navigate a complicated claims process. If you are dealing with the denial of a life insurance claim, it’s essential to understand the rules and regulations that […]

An interpleader action can leave life insurance beneficiaries feeling blindsided, especially when the insurer files a lawsuit to determine who is entitled to the benefits. The insurer essentially steps out of the equation and asks the court to decide who the rightful beneficiary is. This situation often arises in cases where there are disputes, multiple […]

The Thanksgiving holiday season is a time for family reunions, delicious meals, and cherished moments, but it is also a time when traffic accidents and travel-related tragedies tend to increase. The unfortunate reality is that accidents can happen, even during the happiest times of the year. If a loved one is involved in an accident […]